Many Freedom Debt Relief reviews praise the company for having a long-term success rate of settling over $10 billion in debt. However, some people have suffered consequences when negotiating their credit history and should be careful about how much they borrow on different accounts if it’s going to concern them later down the line with an already tight economy as well.

Does Freedom Debt Relief work? And, is this company a good one? In our review of the Freedom debt relief organization, we take an analytical approach to find out whether it’s right for you.

Everything You Need to Know

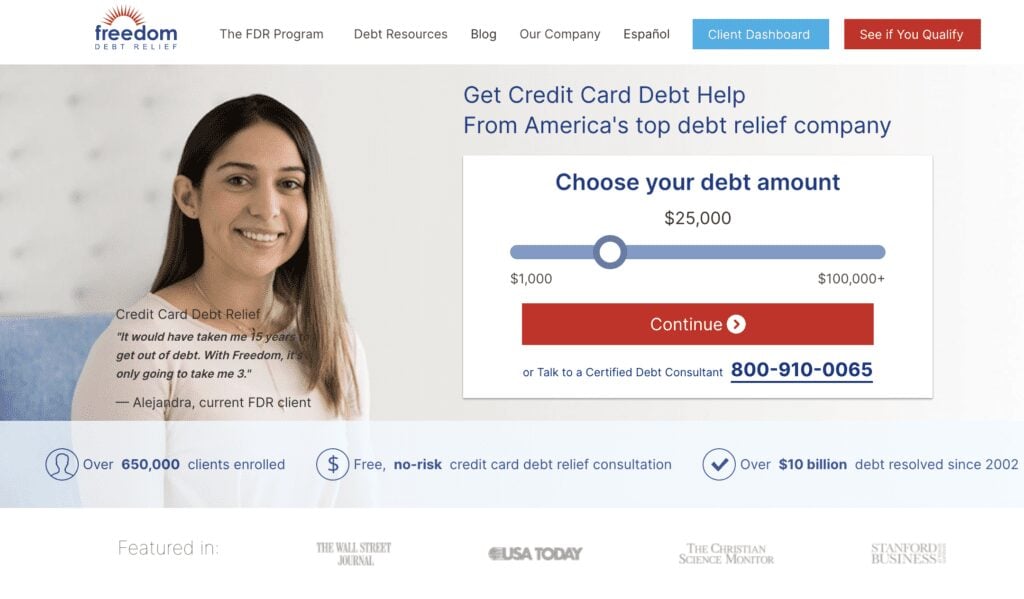

Freedom Debt Relief is a company that has helped hundreds of thousands of people get out from under their debts since 2002. Ther certified debt consultants have enrolled over 600,000 borrowers and settles more accounts than any other competitor in the industry.

With a history of lawsuits, is Freedom Relief the best option for struggling debtors? Let’s take an in-depth look at their company and see what kind of risks they pose.

What Is Freedom Debt Relief Best For?

Freedom Debt Relief is a company that can help you settle unsecured personal loans for less than the original amount of debt. With their service, it’s possible to pay off these debts quicker and cheaper than ever before. The company doesn’t offer credit repair services for secured debt (mortgages, car loans, etc.) or federal student loans.

Freedom Debt Relief Pros and Cons

The main perks of choosing Freedom Debt Relief include:

- Decades of experience

- Excellent working relationship with creditors

- Over $10 billion in settled credit (more than any of their competitors)

- Personal consultation with a certified expert

- Confirmation before every negotiated settlement

- No fees before you see results

- Certified debt consultants provide a free evaluation with no strings attached

- Consumer-centered approach

- Involved in regulation initiatives against poor credit advocacy practices

- Member of the American Fair Credit Council

But there are downsides to opting for the Freedom Debt Relief program:

- Possible credit score damage

- Not available in all states

- Not a quick resolution

- Freedom Debt Relief settled a $25 million lawsuit with the CFPB for deceiving consumers

Debt settlement services are a popular option for people with large amounts of unsecured personal debt. However, regardless if you go through one or not so much as soon as your credit score will take hits from both negotiating and being in too deep in the first place which can damage it over time no matter what company is chosen.

The settlement’s inherent downsides are the main con for choosing Freedom for credit relief. Otherwise, it’s the biggest and best-established agency in the space.

Is Freedom Debt Relief Legit?

Freedom Debt Relief is a well-established company that offers debt settlement services for those who are struggling financially. They are a member of the American Fair Credit Council, with over 18 years of experience and more than $10 billion in settled credit, it’s one of the biggest names when comes to handling settled debts with good standing.

Freedom Debt Relief Qualification Requirements

The company’s website offers free evaluations to help you understand your credit and how it can be improved. To get started, just book an appointment with one of their experts who will analyze the state of both your personal finances as well as those concerning any loans or debts in order for them to make suggestions on what might work best based on that information.

The program may help you pay off your debt and enjoy a more financially secure future You can enroll in all of the high-balance credit card debt (more than $500) to qualify.

Keep in mind, though, that debt settlement services aren’t available in all states. While the program covers 75% of the US, exceptions include Connecticut, Georgia, Hawaii, Illinois, Kansas, Maine, Mississippi, New Hampshire, New Jersey, North Dakota, Oregon, Rhode Island, South Carolina, Vermont, Washington, and West Virginia, and Wyoming.

Freedom Debt can help you with unsecured debts like student loans, medical bills, and utility deposits.

Is Freedom Debt Relief Worth It?

Since every creditor and debt situation are different, settlements will vary. Freedom Debt Relief is able to negotiate up to a 50% reduction in debt. When calculating your savings, it’s essential to factor in Freedom Debt’s fees.

Here are some examples from its recent top settlements:

- The client started with $2,201.00 of enrolled debt and wound up paying $1,093.80 (50% of the original amount). After the fee, they paid 73% of the enrolled debt for total savings of 27%.

- $9,611.00 of enrolled debt was negotiated down to $4,502.35 (a 60% reduction). After fees, they paid 61% of the original amount for 39% of total savings.

- $5,556.00 of the credit went down to $3,484.00 (a 59.99% discount,) but the fees lowered the savings to 17.01%.

You only pay Freedom Debt Relief after it has made a settlement.

How much could you save? The answer is almost always 20% or more, but this can go up to 50%. You also have the option of earning interest on your savings, for some people it’s thousands.

Freedom Debt Relief Services

Freedom Debt Relief offers a number of ways to help you get out from under your debt, with the Freedom dashboard providing an easy-to-follow approach. You can monitor all aspects and progress on this program as well as learn more about how it works by checking their educational videos or reading detailed articles online.

Free Consultation

The best way to get out of credit card debt is by understanding your options. That’s why Freedom Debt offers free consultations with IAPDA-certified consultants who can help you understand what kind of program would work for you and how it will happen over time.

How Does Freedom Debt Relief Work

There are five steps in Freedom Debt’s debt negotiation program:

Debt Evaluation

In order to get out of credit card debt, you need a plan that is tailored just to your needs and budget. Your expert will help create this customized solution by going through all aspects of credit in order to find solutions – not only how much money can be saved but also if it’s right for everyone.

Build Savings

Your first step is to open up an account with the Federal Deposit Insurance Corporation (FDIC). This ensures that you’re getting a safe and sound investment, as well as protecting yourself from financial pitfalls. You’ll start building savings by putting money into this insured FDIC-insured bank account in your name.

Stop Paying

When you stop paying your credit card debts, it can have adverse effects on your credit score. The delinquency of accounts will accrue late fees and penalties which could get costly if not negotiated down enough to avoid incurring these charges in addition as well as any other interests that start accumulating after a certain amount of time has passed since the original loan application or funding date (depending).

Negotiate

The Freedom Debt Relief company has been in the credit card debt settlement services business for nearly two decades. We have a stable working relationship with most lenders, which means that even if you’re dealing with a tough creditor or multiple creditors – we can help get your finances under control and save money.

Settle and Pay Off

Once the lender agrees to a settlement, the company sends you over the terms so you can approve them. Freedom Debt Relief doesn’t have access to your savings account, and it can’t make any decisions without your consent. Once you give the company a yes, the creditor gets paid, and the credit card debt disappears from your credit history.

During this process, you’ll pay off your credit card debt one at a time until they’re all cleared.

How Much Does Freedom Debt Relief Cost?

The company’s fees can be as low as 15% or 25%. The exact amount depends on your state of residence and how much credit card debt you have enrolled with them. They don’t charge an upfront fee but instead charge after each payment has been made, which means they take their percentage off every penny owed.

In addition to the credit card debt settlement services cost, there is a $9.95 fee for opening your dedicated account and $9.95/month for account services.

Freedom Debt Relief Customer Service

Freedom Debt offers stellar customer support with credit consultants and service reps available seven days per week. You can contact the company on its phone number or by emaiL.

The customer service agents are friendly and helpful, but they can’t always help with the problems. Debt settlement services are time-consuming so it’s worth checking out before making any major decisions.

Freedom Debt Relief Customer Reviews

Freedom Debt Relief has an A rating with glowing client reviews, but it recently came under fire from the government for its BBB rating. The lower ratings are due to this recent action against them and not because of service problems customers have experienced thus far, something worth noting! It’s refreshing knowing that their team addresses all issues quickly and without fail (a huge plus).

Freedom Debt Relief reviews on Reddit and consumer opinion sites are very divided. Here are the main takeaways:

The Positives

The main points of praise that come up in the average company review include:

- Outstanding customer support and attention (personal consultations, open during extended hours, and very helpful)

- The most reliable option, as far as unsecured debt settlement services go

- Upfront about the risks and benefits of choosing a credit card debt negotiation solution

- Clarity on how your account is going with 24/7 access to your dashboard

- No decisions are taken without consulting you

- Fees are only due when a debt is settled

Consumers agree that the Freedom Debt Relief program is one of the most prominent and well-established companies in this space, so you can count on them to reach your desired result.

The Negatives

The Freedom Debt Relief company promises success but at the cost of your credit. Once you stop paying off late fees and penalties, damage to scores will follow in order for creditors to receive a lower amount than what was originally loaned out, which means they can’t guarantee that any particular person’s request won’t lead them down an unhappy path with a negative history.

And if you’re suspicious about whether or not the Freedom Debt Relief company is a scam, the answer is clearly no. There will always be unhappy clients, but this fact doesn’t make a company a hoax. In addition, the Freedom Debt Relief program is totally upfront about all the risks that debt relief services may incur. For many reviewers, these risks were simply not worth it, and they didn’t even manage to save that much on the original loan.

Kristin of Cypress, TX

Overall, I had a great experience but, I gave it 3 stars because I felt the company could have resolved my last debt sooner. They tried to make more money from me instead of resolving the debt. I would recommend it for someone with a larger debt.

Tammy of Rogers, AR

By the time most of the accounts were settled, I owed more than when I started, and then I receive 1099’s for the amount I supposedly saved. This was not the way it was explained to me on the front end. I would not have signed up with this company had I known it worked this way, and will not recommend you to anyone.

Michael of Grand Haven, MI

Couldn’t get me a loan to get out of CC debt. You advertise that people can get a loan for CC debt than when you apply you deny. Saying my debt is too much…no ** it is. That’s why I need a loan to get out of CC debt you dumb **. You, people, are morons, communicating was horrible!

April of Hubert, NC

I enrolled in the program with the assurance that my debts would be settled in a timely manner. I was also assured that my final settlements would be less than my enrolled debt. While the first few accounts were paid quickly, the accounts with larger balances were not. I ended up paying more than my original enrolled debt and had to remove an account because it was not being settled in a timely manner. I do not recommend this process.

Barbara of Huntsville, AL

I really can’t give a review because I’ve just started but so far I have been satisfied with the program. I will be more than happy to write a review after I have been at this for a while and can see the progress.

Freedom Debt Relief Lawsuit With The Consumer Financial Protection Bureau

In 2019, the Consumer Financial Protection Bureau filed a lawsuit against Freedom Debt Relief, alleging that the company had violated:

- The Telemarketing Sales Rule is a set of guidelines that can help you protect your company from advance fees and misleading customers when it comes to funds deposited with the business.

- Freedom Debt is a company that specializes in getting loans paid off for its clients. They do this by charging upfront fees before settling the debt and misleading customers into thinking they can negotiate with all of your creditors when really just handling some logistics like recording agreements or sending documents to back up claims made on an individual’s behalf.

When the Freedom Debt Relief scam allegations were settled, they had to refund thousands of dollars from misinformation and pay a $20 million fine and an additional $5 million civil penalty.

Some reviewers still maintain that Freedom Debt Relief lies in the potential results and savings.

The company is under a lot of scrutiny by regulation bodies, but do your research and make sure you’re making an informed decision rather than only trusting their recommendation.

Is Freedom Debt Relief the Best for You?

Debt settlement comes with the risk of long-term credit score damage. So, regardless of which agency you choose, it should be one of your last options. As far as debt negotiation goes, though, Freedom Debt Relief is one of the most reputable companies on the market. They have years of experience, a serious working relationship with most creditors, and a history of billions in settled debt.

Our Freedom Debt Relief review’s bottom line is clear:

Debt settlement is a great option for people who are struggling with the weight of their debts. If you think this might be right for your situation, Freedom Debt Relief will help get things taken care of quickly and effectively.

Alternatives of Freedom Debt Relief

The company’s main competitor in the debt negotiation market is a well-established firm with plenty of options for nonsettlement. These include credit repair services or strategic bankruptcy, depending on your financial situation and needs as an individual citizen.

Freedom Debt Relief vs National Debt Relief

National Debt Relief services also have a minimum debt amount of $7,500, but they can only help you with up to $100,000 in unsecured debt. They’re available in more states than Freedom Debt Relief. The company’s coverage doesn’t include Connecticut, Georgia, Kansas, Maine, New Hampshire, Oregon, South Carolina, Vermont, and West Virginia. Their fees are comparable to Freedom Debt Relief, ranging between 15% and 25% of the enrolled debt.

Final Thoughts

The last resort before bankruptcy, debt relief reviews point out that settlement comes with so many risks. There are potential benefits and savings but consider your options carefully because this will affect you financially in the long run if done wrong or not thought through properly beforehand.

When you need help with your debt, Freedom Debt Relief is one of the best options out there. With years and billions in settled debts as well as thousands of positive reviews online it’s no wonder this company has been around so long.