Welcome to the wild west of the debt consolidation industry, where the line between friend and foe can often blur. Companies like Liberty First Lending tout themselves as financial lifelines, claiming to offer easy solutions to complex problems. But like a mirage in the desert, what appears to be a saving grace may be nothing more than a trap.

Take a glance at Liberty First Lending’s reviews on platforms like the Better Business Bureau (BBB) and Trustpilot, and the allure starts to fade. Some customers praise the company for its services, while others tell tales of frustration and financial woes. As we embark on this critical review of Liberty First Lending, remember the importance of discernment, especially when dealing with your hard-earned money.

Debt consolidation is like a magic trick with your debts – it makes them disappear, only to reappear as a single loan. At face value, this magic trick seems like a practical solution to the problem of multiple debts. However, when you take a closer look at companies like Liberty First Lending, you might start to question if this magic trick is all smoke and mirrors.

So, hold on to your hats (and wallets) as we dive into the world of Liberty First Lending. Will it be a tale of financial salvation or a cautionary tale that serves as a warning to others? Let’s find out. And remember, just as the movie “The Wolf of Wall Street” taught us, in the world of finance, not everything that glitters is gold.

Liberty First Lending Company Background

Liberty First Lending, much like the infamous character Gordon Gekko from the movie “Wall Street”, promises a way out of a financial quagmire, but a closer look at its history and operations may paint a different picture. This company, cloaking itself in the garb of a financial superhero, claims to rid clients of their credit card debt woes through its consolidation services. However, as we explore the company’s background, the shimmering façade begins to wane.

Established with the intent to provide financial solutions, Liberty First Lending has hit several milestones since its inception, growing its operations and customer base steadily. Yet, the company’s journey is not devoid of turbulence. Numerous customer testimonials and case studies suggest a different narrative, one filled with frustration, confusion, and unfulfilled promises.

One such testimony from a disgruntled client on Trustpilot reflects the sentiment of many other customers. The client recounts their experience with Liberty First Lending, describing it as a convoluted process filled with miscommunication and broken promises. Instead of receiving the promised relief from their debt situation, they found themselves further entangled in financial complications.

The company’s background, dotted with such instances, raises a red flag, causing one to question the credibility of Liberty First Lending. It’s essential to remember that just like Gordon Gekko’s infamous mantra in “Wall Street” – “Greed, for lack of a better word, is good” – not everything that seems beneficial on the surface is necessarily so. As we continue our review, keep this cautionary message in mind.

Products/Services

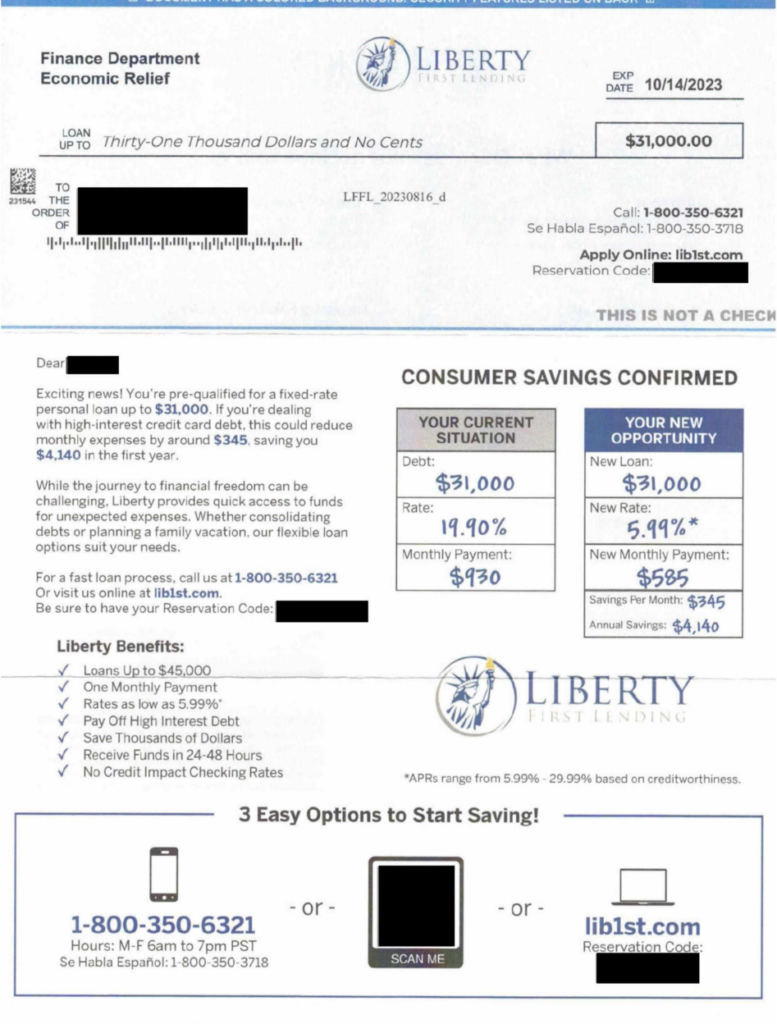

Liberty First Lending, in its suite of services, primarily promotes its debt consolidation program, which promises to simplify the repayment process by combining multiple debts into one. However, while this may sound like a convenient solution, a critical examination of their services reveals potentially concerning aspects.

- Transparency: One of the significant criticisms leveled against Liberty First Lending is its lack of clear communication. Customers have reported experiencing difficulty in getting straight answers about personal loan terms, rates, and fees. The lack of transparency can lead to unexpected costs and potentially worsening financial situations.

- Customer Service: While some customers commend the company for its friendly and helpful staff, others report prolonged wait times, unresponsive representatives, and unresolved issues. The inconsistency in service quality can be concerning, especially when dealing with financial matters.

- Trustworthiness: Some customers have flagged concerns about the company’s trustworthiness based on their experiences. Complaints range from misleading marketing practices to discrepancies in loan terms, contributing to a sense of unease about the company’s integrity.

Furthermore, it’s crucial to note that reviews on BBB and Trustpilot echo these concerns. For instance, one customer on BBB reported being hit with unexpected fees, claiming the company was not upfront about the additional costs during the initial stages.

As we continue to examine Liberty First Lending and its offerings, remember the old adage, “If it’s too good to be true, it probably is.”

Risks and Controversies

Amidst the world of debt consolidation, where many companies paint a picture of financial saviors, Liberty First Lending has not escaped the industry’s inherent risks and controversies. Reports of dubious practices, customer complaints, and the threat of legal action have cast a shadow over the company’s operations.

A few of the recurring issues associated with Liberty First Lending are:

- Hidden Fees: Numerous customers have reported being charged unexpected fees after committing to the company’s services. In many cases, these fees were not explicitly explained during the initial consultation, leading to customer dissatisfaction and mistrust.

- Misleading Marketing Practices: Specific marketing techniques used by Liberty First Lending have raised eyebrows. Some customers claim that they were enticed by promises that did not materialize, resulting in broken trust and financial trouble.

- Poor Communication: Many customers have voiced complaints about inconsistent or inadequate communication from the company, specifically about loan terms and conditions. This lack of clarity can lead to confusion and financial missteps.

To understand the extent of these controversies, we invite you to participate in our interactive survey. Your input can shed light on the prevailing perceptions of Liberty First Lending and help potential customers make informed decisions.

Remember, delving into debt consolidation is not a decision to take lightly. It’s crucial to fully understand the risks involved and the credibility of the company you choose to partner with. As the adage goes, “Forewarned is forearmed.” When dealing with your financial future, caution cannot be overstated.

Conclusion

As we draw this critical review of Liberty First Lending to a close, it’s clear that navigating the world of debt consolidation is no easy task. Companies like Liberty First Lending present themselves as the solution to your financial woes, but a deeper dive often reveals a more complex and potentially concerning picture.

From claims of hidden fees to reports of inconsistent customer service and questionable marketing practices, Liberty First Lending carries its fair share of controversies. These factors serve as a reminder that, when it comes to your financial health, it’s crucial to tread carefully, conduct thorough research, and question every promise made.

Much like the misleading allure of the One Ring in “The Lord of the Rings,” it’s essential to remember that easy solutions can sometimes lead to complicated problems. As you consider your next steps in managing your debt, we urge you to consider the potential risks associated with companies like Liberty First Lending.

To assist you in this journey, we invite you to refer to our comprehensive debt consolidation comparison chart. It provides valuable insights into various service providers, aiding you in your quest to regain financial stability.

In conclusion, remember that the path to financial freedom is rarely a straight one. There will be twists and turns, but with caution, skepticism, and the right resources, you can make informed decisions and reclaim control over your finances.

FAQs

- What is Liberty First Lending and what services do they offer? Liberty First Lending is a financial services company that offers lending options such as mortgages, home equity loans, and refinancing. They claim to provide solutions for a wide range of financial situations, including low credit scores or high debt-to-income ratios.

- How reliable is Liberty First Lending? Some customers have expressed satisfaction with their services, but others have raised concerns about the company’s transparency, customer service quality, and hidden fees. It is strongly advised to thoroughly research and understand their terms before proceeding.

- Does Liberty First Lending offer competitive interest rates? While Liberty First Lending advertises competitive rates, it’s crucial to compare these rates with other lenders. Some consumers have reported higher than expected interest rates after initially being quoted lower rates.

- What is the application process like with Liberty First Lending? The application process with Liberty First Lending is largely done online or over the phone. It’s important to note that some customers have reported difficulties during the application process, including unresponsive customer service and delays in loan approval and funding.

- Are there any hidden fees associated with Liberty First Lending’s loans? Some customers have reported hidden fees associated with their personal loans from Liberty First Lending. It is essential to read all documentation carefully, ask for clarification when needed, and understand all the costs involved.

- How does Liberty First Lending handle customer complaints and disputes? There have been mixed reviews regarding Liberty First Lending’s customer complaint resolution. Some customers have reported a satisfactory resolution, while others have indicated that their complaints were not adequately addressed.

- Does Liberty First Lending have a strong reputation in the lending industry? Liberty First Lending’s reputation in the industry is somewhat mixed. While they have received positive reviews for some of their services, there have also been negative reports ranging from poor customer service to concerns about their transparency and disclosure of fees.

- What types of loans does Liberty First Lending specialize in? Liberty First Lending primarily offers home loans, including mortgages and refinancing. It is advised to be cautious and fully understand the terms of these loans, as some customers have reported unexpected changes in interest rates and loan terms.

- How transparent is Liberty First Lending in their loan process? Transparency has been an issue raised by some customers of Liberty First Lending. Issues reported include unexpected changes in loan terms and rates, and lack of communication or clarity from the company.

- How does Liberty First Lending compare with other lending institutions? While Liberty First Lending offers a variety of loan types, potential borrowers should approach with caution and compare their offerings with other lenders. The company’s customer service and transparency have been questioned, and it is crucial to fully understand the terms of any loan before committing.

No Comments

Visitor Rating: 5 Stars