TurboDebt is a debt settlement company that offers various debt relief services to consumers. Unlike other debt settlement companies, TurboDebt is not rated by the Better Business Bureau (BBB). This lack of rating raises questions about the quality of their services and customer satisfaction. Therefore, the purpose of this blog post is to gather TurboDebt BBB reviews and complaints and analyze them to provide a better understanding of their services. By examining the experiences of past and current customers, we hope to provide readers with valuable insights into the quality of their services and whether they are a viable option for those seeking debt relief.

Company Overview

TurboDebt offers debt relief services, which include debt negotiation, credit counseling, and debt consolidation. They charge fees based on the amount of debt that they are able to settle. The process starts with a consultation where they evaluate the client’s financial situation and create a customized debt settlement plan. Once the client agrees to the plan, TurboDebt begins negotiating with the creditors. They aim to settle the debts for less than what the client owes. It is important to note that TurboDebt is not rated or accredited by the Better Business Bureau (BBB).

TurboDebt BBB Reviews and Complaints

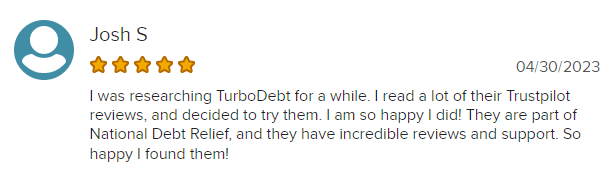

After compiling and analyzing BBB reviews and complaints about TurboDebt, it was found that the most common themes were customer service, results, fees, and communication. Many positive reviews praised TurboDebt’s customer service, citing helpful and knowledgeable representatives who made the debt relief process less daunting.

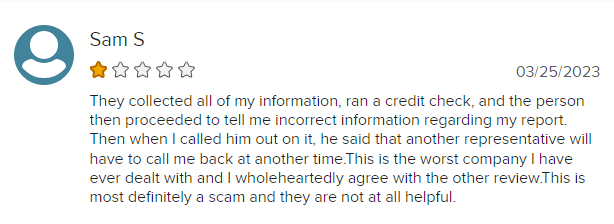

Negative reviews, on the other hand, were often critical of the company’s fees, claiming they were too high or that additional fees were not disclosed upfront. Some customers also expressed frustration with the lack of communication from TurboDebt regarding the status of their debt relief progress.

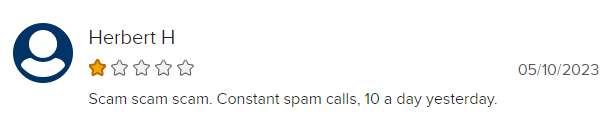

Apart from being unaccredited, TurboDebt has been given a 3-star rating out of 5 on the BBB website, which is based on 7 customer reviews. The rating represents the thoughts and experiences of these customers who have expressed their opinions on the website. You can read some of these reviews below:

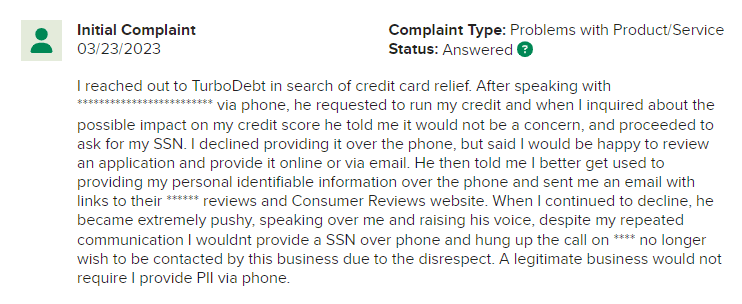

In addition, TurboDebt has received a single complaint on their BBB profile. This complaint could offer useful insights into the types of problems that some customers have encountered and how the company has handled them. To get a clearer picture of how TurboDebt deals with customer issues, potential clients should examine these complaints and any responses provided by the company.

To sum up, although the unaccredited status and BBB rating of TurboDebt may cause worries for some prospective customers, it is crucial to assess the company using various sources of information such as customer feedback, recommendations, and evaluations from third-party sources. By adopting this comprehensive approach, you can make an informed decision on whether TurboDebt is the ideal debt settlement provider that meets your requirements.

FAQs

Q1: What is TurboDebt?

A1: TurboDebt is a debt settlement company that helps consumers negotiate with creditors to reduce their outstanding debts.

Q2: Is TurboDebt accredited by the Better Business Bureau (BBB)?

A2: No, TurboDebt is not yet rated or accredited by the BBB.

Q3: How many BBB complaints has TurboDebt received?

A3: As of July 2023, TurboDebt has received only 1 complaint on their BBB profile since their file was opened in December 2022.

Q4: What are the common complaints against TurboDebt?

A4: The common complaints against TurboDebt include poor customer service, ineffective debt settlement negotiations, and misleading advertising.

Q5: Does TurboDebt have a high success rate in settling debts?

A5: TurboDebt claims to have a success rate of over 90% in settling debts, but this cannot be independently verified.

Q6: What fees does TurboDebt charge?

A6: TurboDebt charges a percentage of the total debt enrolled in their program as their fee, typically ranging from 15% to 25%.

Q7: Does TurboDebt offer a money-back guarantee?

A7: Yes, TurboDebt offers a money-back guarantee if they are unable to settle at least one of your debts within the first 90 days of enrollment.

Q8: Is TurboDebt a reputable company?

A8: TurboDebt seems to be a reputable debt settlement company, but consumers should still do their own research and due diligence before enrolling in their program.

Q9: How long does it take to settle debts through TurboDebt?

A9: The length of time it takes to settle debts through TurboDebt varies depending on the amount of debt enrolled, the creditors involved, and other factors. It typically takes between 2 to 4 years.

Q10: Can TurboDebt help with all types of debts?

A10: TurboDebt can only help with unsecured debts, such as credit card debts, personal loans, and medical bills. They cannot help with secured debts, such as mortgages or car loans.

Glossary

- TurboDebt – A debt settlement company founded in 1998 that helps people in debt negotiate with creditors to lower their debt.

- BBB – Better Business Bureau, a non-profit organization that provides ratings and reviews for businesses.

- Debt Settlement – The process of negotiating with creditors to pay off debt for a lower amount than what is owed.

- Debt Relief – Any method or program that helps people get out of debt.

- Debt Consolidation – Combining multiple debts into one payment, usually at a lower interest rate.

- Credit Score – A numerical representation of a person’s creditworthiness based on their credit history.

- Credit Counseling – A service that helps people manage their debt and improve their credit score.

- Consumer Complaint – A formal statement made by a customer about a negative experience with a product or service.

- Settlement Agreement – A written agreement between a debtor and creditor outlining the terms of a debt settlement.

- Debt Negotiation – The act of discussing and agreeing to a payment plan or settlement amount with a creditor.

- Debt Collector – A person or company that collects unpaid debts on behalf of creditors.

- Debt Relief Scam – A fraudulent debt relief program that takes advantage of vulnerable people in debt.

- Debt Validation – The process of verifying that a debt is valid and legally owed.

- Debt Forgiveness – The act of forgiving or canceling all or part of a debt owed.

- Debt Management Plan – A program that helps people pay off their debts by creating a payment plan and negotiating with creditors.

- Debt Settlement Company – A company that specializes in negotiating with creditors to lower a person’s debt.

- Debt Consolidation Loan – A loan used to pay off multiple debts, usually at a lower interest rate.

- Debt Repayment Plan – A plan to pay off debt over a set period of time.

- Debt Reduction – The act of reducing or eliminating debt.

- Debt Relief Program – A program designed to help people get out of debt, often through debt settlement or consolidation.

- Credit Card Debt: Credit card debt refers to the amount of money that a person owes to a credit card company, resulting from using the credit card to make purchases or withdraw cash advances. The debt accumulates when the borrower is unable to pay off the balance in full by the due date, and interest charges are added to the outstanding amount.

- Debt Collection Agency: A debt collection agency is a company that specializes in collecting unpaid debts on behalf of creditors or other businesses. They may use various tactics to recover the debt, such as phone calls, letters, and legal action.

- Debt Management Program: A Debt Management Program is a financial plan designed to help individuals or businesses pay off their debts by consolidating multiple debts into a single payment and negotiating lower interest rates with creditors. The program typically involves working with a credit counseling agency to create a personalized repayment plan and budget.